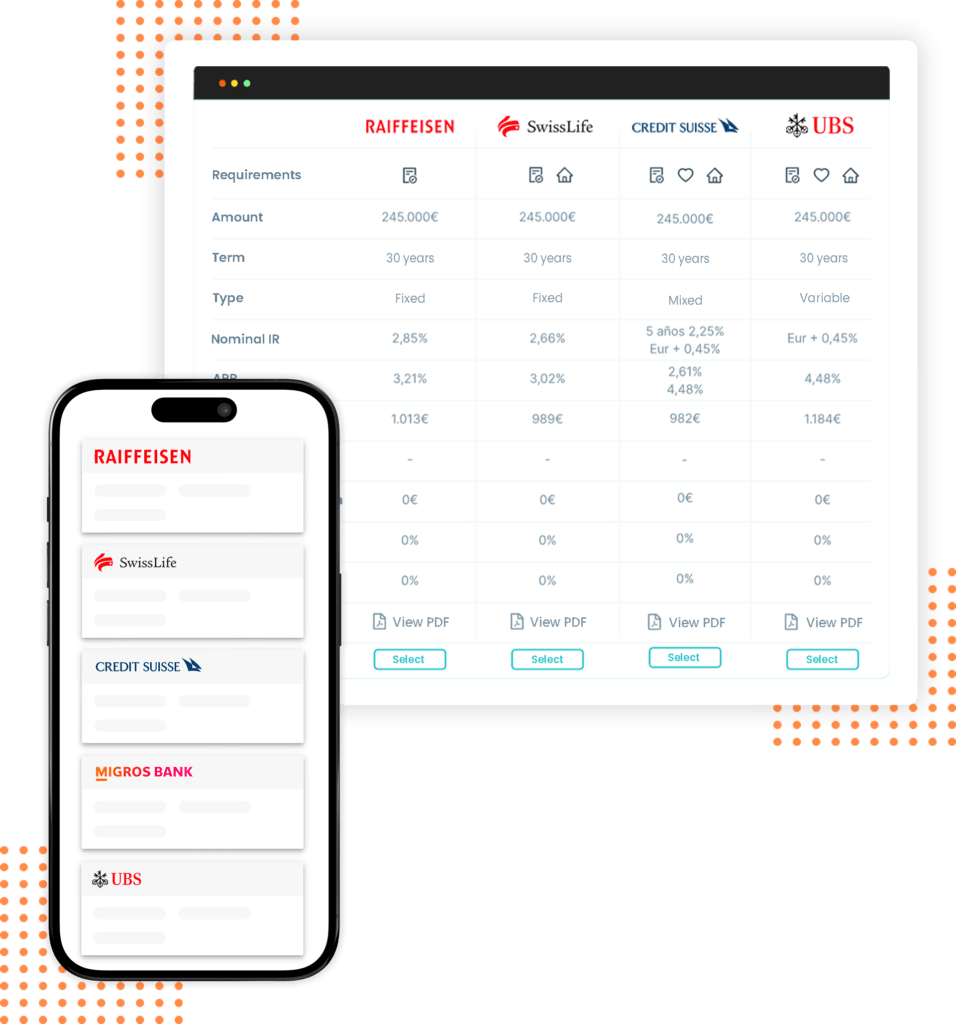

Get the best rates on the market

by comparing more than 130 lenders

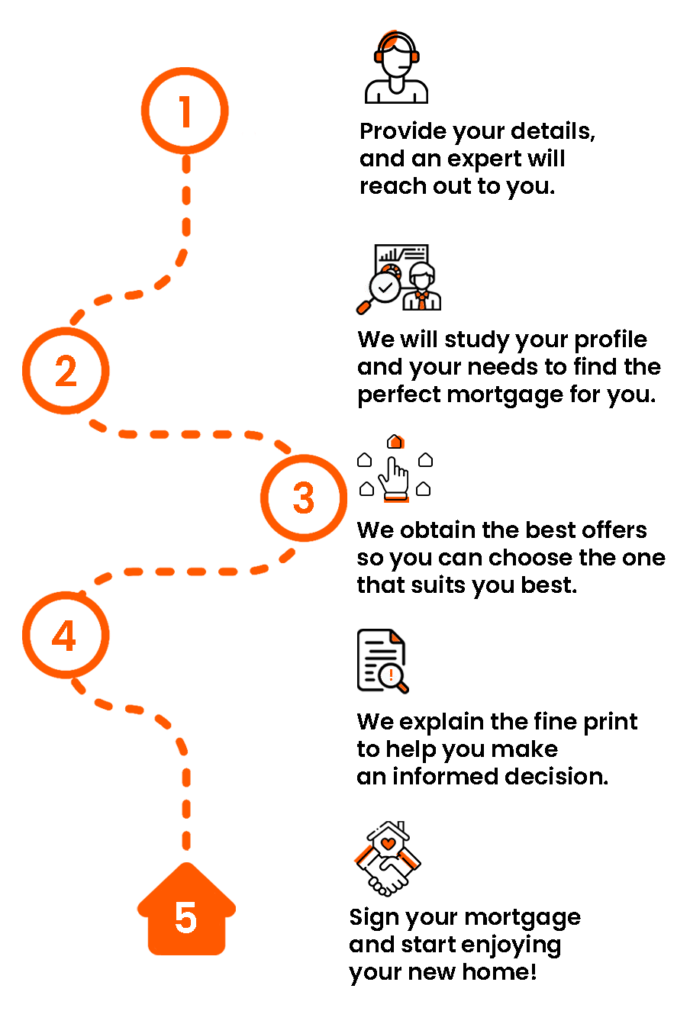

We Search, Compare, and

Negotiate for You

From start to finish, our experts will guide you and answer your questions.

Our bank connections expedite your mortgage process.

We negotiate with banks to secure the best mortgage terms

Our local presence means we have a deep understanding of regional markets and can provide tailored mortgage solutions that meet your specific needs.

Fast, Transparent, and Tailored to Your Needs.

Explore our suite of calculators to help you determine mortgage affordability, expenses, and more.

Discover the most competitive mortgage rates available tailored to your needs.

Analyze and compare various mortgage options to find the one that suits you best.

The platform allowed us to easily compare available mortgage options in Switzerland. Thanks to the broker, we found financing that perfectly meets our needs. Highly recommended!

Expert and helpful consultants guided us through every stage of the mortgage process. Thanks to them, we obtained exceptional conditions. Impeccable and free service.

Thanks to the platform, we found the ideal mortgage for our home in Switzerland. The broker followed us step by step, ensuring we got the best possible conditions. An indispensable and free service."

We used the platform to compare various mortgages and were immediately put in touch with a professional broker. We secured a very competitive interest rate. Very satisfied with the service.

The comparison site is very intuitive and easy to use. After finding the best options, the broker assisted us professionally. We managed to renegotiate our mortgage with much more advantageous conditions.

I was impressed by the broker's professionalism. Thanks to the platform, we quickly found the right mortgage and were attentively followed throughout the process. Highly recommended!

We found the ideal mortgage for our new home thanks to this platform. The broker's support was essential to obtain advantageous conditions. We are extremely satisfied with the service received.

A mortgage is a loan specifically used to purchase real estate, where the property itself serves as collateral. This means if you fail to repay the loan, the lender can take possession of the property.

In Switzerland, the most common types of mortgages are:

Choosing the right mortgage depends on various factors, including:

Several factors can influence your mortgage rate:

The loan-to-value (LTV) ratio is a measure of how much you are borrowing compared to the value of the property. It is calculated by dividing the mortgage amount by the property value and is expressed as a percentage. For example, if you’re borrowing CHF 400,000 on a property worth CHF 500,000, your LTV ratio is 80%.

Mortgage points are fees paid upfront to reduce the interest rate on your loan. One point typically equals 1% of the mortgage amount. Paying points can lower your monthly payments and total interest over the life of the loan, but it requires a larger upfront payment. Consider points if you plan to stay in your home long-term and want to lower your overall interest costs.

Closing costs are fees associated with finalizing a mortgage and purchasing a property. They typically include:

Yes, you can pay off your mortgage early, but it may come with prepayment penalties depending on your mortgage agreement. Some lenders allow early repayment without penalties, while others may charge fees if you pay off the loan before the end of the term.

Missing a mortgage payment can lead to late fees and negatively impact your credit score. If you continue to miss payments, your lender may start foreclosure proceedings, which could result in losing your home. If you’re struggling with payments, contact your lender as soon as possible to discuss possible solutions, such as a payment plan or mortgage modification.

Refinancing is the process of replacing your existing mortgage with a new one, often with different terms. People refinance to take advantage of lower interest rates, reduce monthly payments, change the loan term, or access home equity. Consider refinancing if it aligns with your financial goals.

To improve your chances of mortgage approval:

For personalized mortgage advice, you can apply for a Free Consultation here.