From start to finish, our experts will guide you and answer your questions.

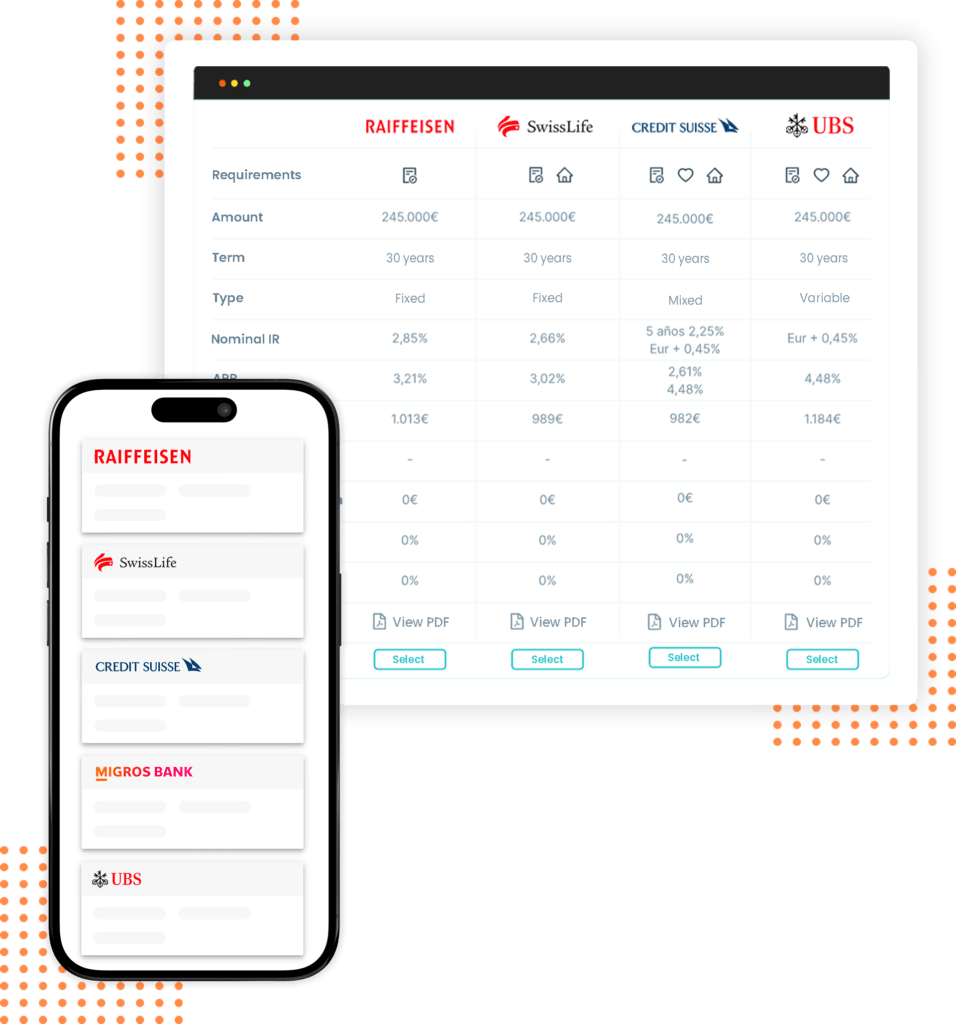

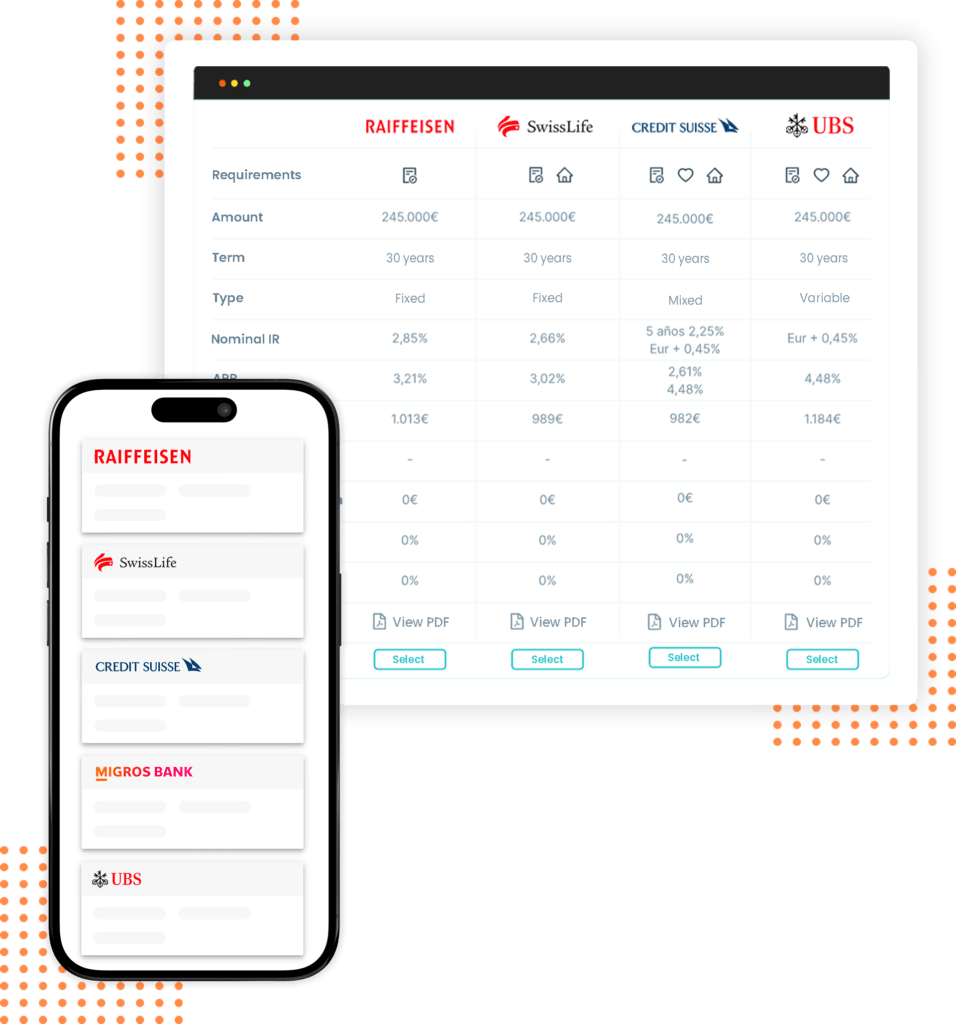

Our bank connections expedite your mortgage process.

We negotiate with banks to secure the best mortgage terms

A mortgage is a loan specifically used to purchase real estate, where the property itself serves as collateral. This means if you fail to repay the loan, the lender can take possession of the property.

In Switzerland, the most common types of mortgages are:

Choosing the right mortgage depends on various factors, including:

Several factors can influence your mortgage rate:

The loan-to-value (LTV) ratio is a measure of how much you are borrowing compared to the value of the property. It is calculated by dividing the mortgage amount by the property value and is expressed as a percentage. For example, if you’re borrowing CHF 400,000 on a property worth CHF 500,000, your LTV ratio is 80%.

Mortgage points are fees paid upfront to reduce the interest rate on your loan. One point typically equals 1% of the mortgage amount. Paying points can lower your monthly payments and total interest over the life of the loan, but it requires a larger upfront payment. Consider points if you plan to stay in your home long-term and want to lower your overall interest costs.

Closing costs are fees associated with finalizing a mortgage and purchasing a property. They typically include:

Yes, you can pay off your mortgage early, but it may come with prepayment penalties depending on your mortgage agreement. Some lenders allow early repayment without penalties, while others may charge fees if you pay off the loan before the end of the term.

Missing a mortgage payment can lead to late fees and negatively impact your credit score. If you continue to miss payments, your lender may start foreclosure proceedings, which could result in losing your home. If you’re struggling with payments, contact your lender as soon as possible to discuss possible solutions, such as a payment plan or mortgage modification.

Refinancing is the process of replacing your existing mortgage with a new one, often with different terms. People refinance to take advantage of lower interest rates, reduce monthly payments, change the loan term, or access home equity. Consider refinancing if it aligns with your financial goals.

To improve your chances of mortgage approval:

For personalized mortgage advice, you can apply for a Free Consultation here.