A fixed rate mortgage is a popular choice for many homeowners due to its stability and predictability. In Switzerland, where the mortgage market can be intricate, understanding the nuances of a fixed rate mortgage is crucial for making informed financial decisions.

What is a Fixed Rate Mortgage?

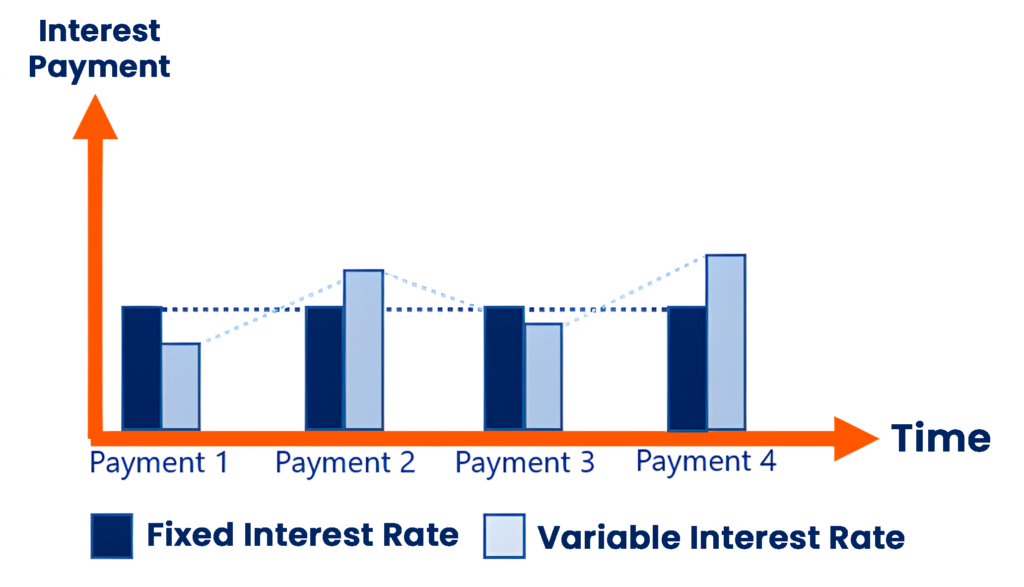

A fixed rate mortgage is a loan where the interest rate remains constant throughout the term of the loan. This stability makes it easier for borrowers to budget their monthly payments without worrying about fluctuations in interest rates.

Key Characteristics of Fixed Rate Mortgage

- Interest Rate Stability: The main feature is that the interest rate does not change during the mortgage term.

- Predictable Payments: Monthly payments remain the same, making financial planning more straightforward.

- Long-Term Planning: Ideal for those who want to lock in a specific rate and protect themselves from future interest rate increases.

Benefits of a Fixed Rate Mortgage

Fixed rate mortgages offer several advantages:

Financial Predictability

With a fixed rate mortgage, borrowers benefit from consistent monthly payments. This predictability aids in budgeting and financial planning, especially in a volatile economic environment.

Protection Against Interest Rate Fluctuations

Borrowers are shielded from interest rate hikes, which can be particularly beneficial during periods of rising rates.

Simplicity and Stability

Fixed rate mortgages are straightforward compared to variable rate mortgages, offering a clear repayment plan over the life of the loan.

Swiss Fixed Rate Mortgage Market

Switzerland’s mortgage market is unique, influenced by the country’s financial stability and regulatory environment. Understanding the local market dynamics is essential for making informed decisions.

Overview of Swiss Mortgage Terms

- Typical Terms: Fixed rate mortgages in Switzerland usually range from 5 to 15 years.

- Interest Rates: Rates are influenced by the Swiss National Bank’s policies and economic conditions.

Key Lenders and Products

- Major Banks: UBS, Credit Suisse, and Zürcher Kantonalbank.

- Alternative Lenders: Regional banks and specialized mortgage providers.

Essential Paperwork for Fixed Rate Mortgages in Switzerland

Gathering the right documents is crucial for securing a mortgage. Here’s a detailed list of the essential paperwork needed.

Basic Documentation

- Proof of Identity: Passport or Swiss ID.

- Proof of Income: Recent pay slips or tax returns.

- Proof of Employment: Employment contract or letter from employer.

- Proof of Assets: Bank statements and property valuation reports.

Additional Documentation for Specific Applicants

- Self-Employed Individuals: Business accounts, profit and loss statements, and a detailed business plan.

- Non-Swiss Residents: Residency permits, proof of stable income, and additional financial documentation.

- First-Time Buyers: Pre-approval letters, detailed personal financial statements.

Application Process for a Fixed Rate Mortgage

Understanding the application process can streamline your mortgage journey.

Step-by-Step Guide

- Assess Your Financial Situation: Review your credit score, savings, and overall financial health.

- Research Lenders: Compare offers from various banks and lenders.

- Gather Documentation: Collect all required paperwork.

- Submit Application: Complete and submit your mortgage application.

- Mortgage Offer: Review and accept the mortgage offer from the lender.

- Finalizing the Loan: Sign the mortgage agreement and complete the transaction.

Tips for a Smooth Application

- Prepare Thoroughly: Ensure all documents are complete and accurate.

- Consult with Experts: Consider seeking advice from a mortgage broker or financial advisor.

- Review Terms Carefully: Understand all terms and conditions before signing.

Considerations for Different Applicant Types

Different applicant types may face specific challenges and requirements.

Self-Employed Applicants

- Income Verification: Provide comprehensive financial records.

- Higher Interest Rates: Be prepared for potentially higher rates due to perceived risk.

Non-Swiss Residents

- Residency Status: Must provide proof of legal residency and stable income.

- Lender Requirements: Some lenders may have stricter criteria for non-residents.

First-Time Home Buyers

- Down Payment: Be prepared for a higher down payment requirement.

- Additional Documentation: Might need extra paperwork to demonstrate financial stability.

Expert Insights and Advice

Gain insights from industry experts to enhance your understanding of fixed rate mortgages.

Expert Opinions

- Mortgage Brokers: Advice on choosing the best mortgage product based on your financial situation.

- Financial Advisors: Tips on managing mortgage payments and planning for future financial goals.

Market Trends and Predictions

- Interest Rate Trends: Analysis of current and future interest rate trends.

- Economic Factors: How broader economic conditions might impact mortgage rates.

Common Questions About Fixed Rate Mortgages

Addressing frequently asked questions can help clarify common concerns.

What Happens if Interest Rates Fall?

If interest rates decrease, your fixed rate mortgage will remain at the agreed upon rate. However, some lenders offer options to refinance.

Can I Pay Off My Fixed Rate Mortgage Early?

Most lenders allow early repayment, but there may be penalties or fees. Review your mortgage agreement for details.

How Do I Choose the Right Term Length?

Consider your long term financial goals and how long you plan to stay in your home when choosing the term length

Conclusion

A fixed rate mortgage offers stability and predictability, making it a compelling option for many borrowers. By understanding the intricacies of the Swiss mortgage market, gathering the necessary documentation, and preparing thoroughly, you can navigate the mortgage process with confidence.