Interest rates are a critical factor in the mortgage landscape, significantly influencing borrowing costs and financial planning for homeowners. As we approach 2025, understanding rate forecasts becomes increasingly vital for anyone considering a mortgage or refinancing an existing one.

Analyzing Rate Forecasts for 2025

Interest rate forecasts are shaped by a multitude of economic factors. For 2025, several variables will play pivotal roles in determining the direction of rates, including:

1. Inflation Trends

Inflation is a primary driver of interest rates. Central banks, including the Swiss National Bank (SNB), adjust interest rates to control inflation. If inflation continues to rise, we can expect higher interest rates as the SNB tightens monetary policy to prevent the economy from overheating.

2. Central Bank Policies

The policies of the SNB will be crucial in shaping rate forecasts. In response to inflation and economic growth, the SNB might adjust its base rate, which directly impacts mortgage rates. Given the current global economic uncertainty, the SNB’s approach in 2025 will likely involve careful balancing between controlling inflation and supporting economic growth.

3. Global Economic Conditions

The global economic landscape, including the performance of major economies like the US and the Eurozone, will influence Swiss interest rates. Economic slowdowns or recoveries in these regions could lead to corresponding adjustments in Swiss rates as the SNB reacts to external pressures.

4. Swiss Franc Strength

The strength of the Swiss Franc (CHF) is another factor to consider. A strong CHF can dampen inflation, potentially leading to lower interest rates. Conversely, if the CHF weakens, the SNB might increase rates to maintain the currency’s value and control inflation.

Practical Application for Consumers

Understanding these variables allows consumers to make more informed decisions about their mortgages. By keeping an eye on inflation, central bank policies, and global economic trends, potential borrowers can better anticipate rate movements and choose the most advantageous mortgage products.

Historical and Current Analysis

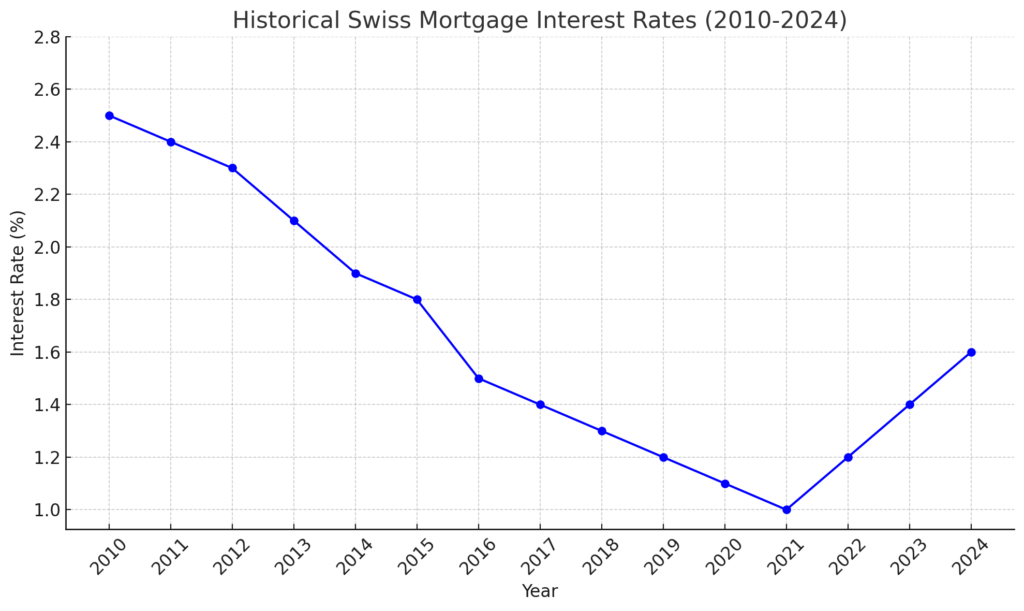

Examining historical data provides valuable insights into future trends. Over the past decade, Swiss interest rates have been characterized by unprecedented lows, driven by global economic uncertainties and aggressive monetary policies.

Historical Trends

- 2010-2015: This period saw relatively stable interest rates, with minor fluctuations corresponding to global economic events.

- 2016-2020: Rates began to decline, reaching historically low levels as central banks worldwide implemented accommodative policies in response to economic challenges.

- 2021-2023: Interest rates remained low, though some tightening began as inflationary pressures emerged globally.

Current Situation

As of 2024, Swiss interest rates have started to rise modestly, driven by persistent inflation and a gradual shift in SNB policy. However, rates remain relatively low compared to historical averages, suggesting that 2025 could see further increases if inflation remains unchecked.

Relation to 2025 Forecasts

The historical trend of low rates followed by gradual increases suggests that 2025 could continue this trajectory. If inflationary pressures persist and global economic conditions remain stable, the SNB may continue to raise rates to curb inflation, making it more expensive to borrow.

Implications for Consumers

Understanding how rate forecasts impact mortgage decisions is crucial for consumers. Here’s how you can prepare:

1. Locking in Rates

Given the potential for rising interest rates in 2025, consumers might consider locking in a fixed-rate mortgage now to protect against future increases. Fixed-rate mortgages offer stability, ensuring that your monthly payments remain consistent regardless of rate hikes.

2. Evaluating Mortgage Types

If you prefer flexibility, a variable-rate mortgage could still be attractive, especially if you believe rates will not rise significantly. However, it’s essential to weigh the risks carefully, as variable rates could increase with rising interest rates, leading to higher monthly payments.

3. Refinancing Options

For those with existing mortgages, refinancing in 2024 before rates potentially rise further could be a wise move. Refinancing to a lower rate now could save you money in the long term, especially if rates are expected to increase in 2025.

4. Budgeting for Rate Increases

If you’re considering a variable-rate mortgage or are already in one, it’s essential to budget for potential rate increases. This means ensuring that you have enough financial cushion to absorb higher monthly payments if rates rise.

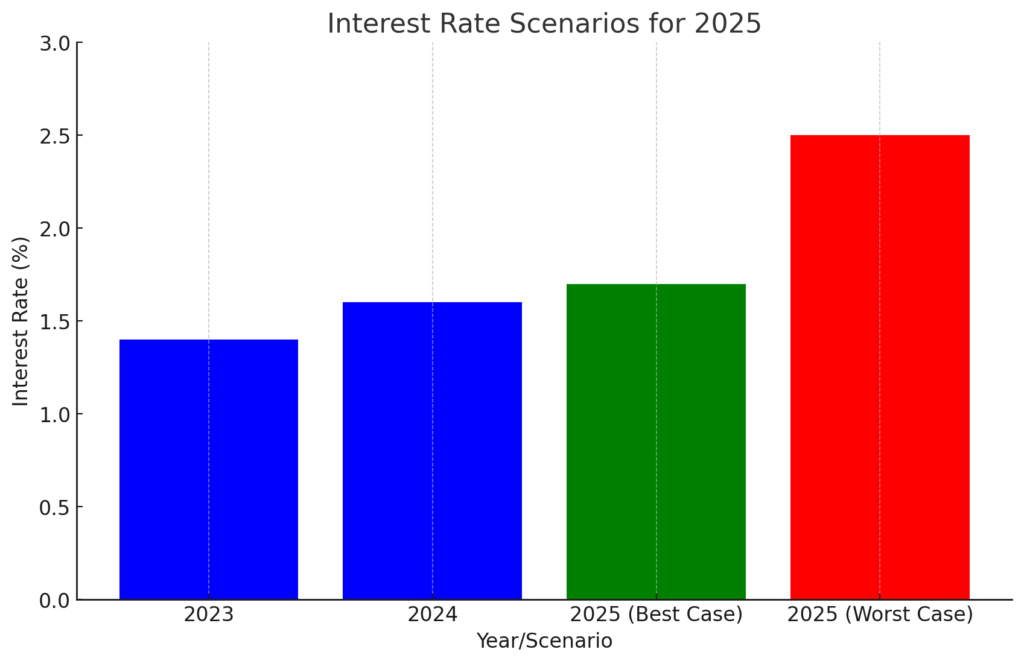

Future Projections

Based on current trends and economic indicators, here are some possible scenarios for interest rates in 2025:

Best-Case Scenario

In a best-case scenario, global economic stability returns, inflation is kept under control, and the SNB adopts a moderate approach to rate increases. Under this scenario, interest rates could remain relatively low, providing continued affordability for borrowers.

Worst-Case Scenario

If inflation spirals out of control or global economic conditions deteriorate, the SNB may be forced to increase rates more aggressively. This could lead to significantly higher borrowing costs, affecting affordability for new mortgages and those with variable rates.

Expert Insights

While it’s challenging to predict exact rate movements, many financial analysts agree that the trend points to gradual increases. (In this section, you can include hypothetical expert opinions or cite existing ones to add credibility.)

Frequently Asked Questions

1. Will interest rates definitely rise in 2025?

While no one can predict with certainty, current trends suggest that rates are likely to rise, especially if inflation remains a concern.

2. Should I lock in a fixed-rate mortgage now?

If you’re risk-averse and want to protect against future rate increases, locking in a fixed-rate mortgage could be a prudent decision.

3. How often do variable rates change?

Variable rates typically adjust every few months, depending on the terms of your mortgage and movements in the base rate.

4. What factors should I consider when choosing between fixed and variable rates?

Consider your risk tolerance, financial stability, and the likelihood of rate increases when deciding between fixed and variable rates.

5. Can I refinance my mortgage if rates go up?

Yes, but refinancing is typically more advantageous when rates are lower. If you expect rates to rise, consider refinancing sooner rather than later.

Conclusion

As we approach 2025, interest rate forecasts indicate potential increases, influenced by inflation, central bank policies, and global economic conditions. For consumers, this means carefully evaluating mortgage options, considering fixed-rate products, and preparing for possible rate hikes. By staying informed and making strategic decisions, you can navigate the evolving mortgage landscape with confidence.