Variable rate mortgages, also known as adjustable-rate mortgages, offer a different approach compared to fixed-rate mortgages. In Switzerland, where the mortgage market is robust and diverse, understanding the nuances of variable rate mortgages is crucial for making well-informed financial decisions.

What is a Variable Rate Mortgage?

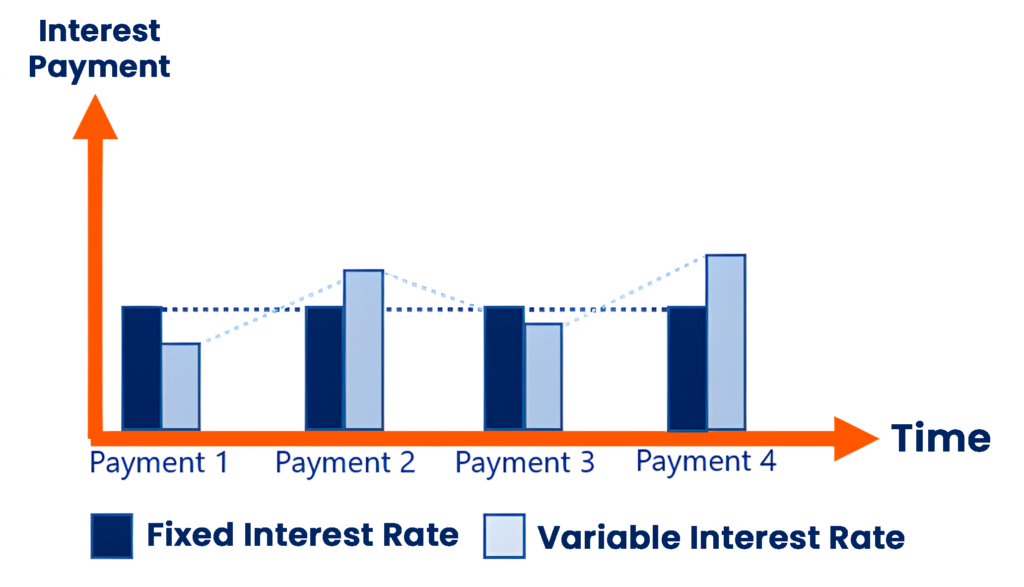

A variable rate mortgage is a loan where the interest rate fluctuates based on market conditions. Unlike fixed-rate mortgages, the interest rate on a variable rate mortgage can change at specified intervals, affecting the borrower’s monthly payments.

Key Characteristics of Variable Rate Mortgages

- Interest Rate Fluctuations: The rate adjusts periodically based on market conditions or a specific index.

- Potential for Lower Initial Rates: Often offers lower initial rates compared to fixed-rate mortgages.

- Rate Caps and Floors: Some variable rate mortgages have caps or floors to limit how much the rate can change.

Benefits of a Variable Rate Mortgage

Variable rate mortgages can offer several advantages depending on market conditions.

Potential for Lower Initial Interest Rates

Variable rate mortgages often start with lower interest rates compared to fixed-rate mortgages, which can result in lower initial monthly payments.

Flexibility

The ability to benefit from falling interest rates can make variable rate mortgages appealing if you expect rates to decline.

Possible Lower Overall Costs

If interest rates remain stable or decline, the overall cost of borrowing may be less with a variable rate mortgage compared to a fixed-rate mortgage.

Swiss Variable Rate Mortgage Market

Understanding the Swiss market dynamics is crucial for evaluating variable rate mortgages effectively.

Overview of Swiss Mortgage Terms

- Typical Terms: Variable rate mortgages in Switzerland often come with terms ranging from 1 to 5 years.

- Interest Rate Indexes: Rates are typically tied to the Swiss National Bank’s (SNB) LIBOR rate or other benchmark indexes.

Key Lenders and Products

- Major Banks: UBS, Credit Suisse, and Zürcher Kantonalbank offer a variety of variable rate mortgage products.

- Alternative Lenders: Regional banks and specialized financial institutions also provide competitive variable rate mortgage options.

Essential Paperwork for Variable Rate Mortgages in Switzerland

Gathering the appropriate documentation is vital for securing a variable rate mortgage.

Basic Documentation

- Proof of Identity: Passport or Swiss ID.

- Proof of Income: Recent pay slips or tax returns.

- Proof of Employment: Employment contract or a letter from your employer.

- Proof of Assets: Bank statements and property valuation reports.

Additional Documentation for Specific Applicants

- Self-Employed Individuals: Business financial statements, tax returns, and a detailed business plan.

- Non-Swiss Residents: Residency permits, proof of stable income, and additional financial documentation.

- First-Time Buyers: Detailed personal financial statements and pre-approval letters.

Application Process for a Variable Rate Mortgage

Navigating the application process can streamline your mortgage experience.

Step-by-Step Guide

- Evaluate Your Financial Situation: Review your credit score, savings, and overall financial health.

- Research Lenders: Compare different offers from various banks and lenders.

- Collect Documentation: Gather all necessary paperwork.

- Submit Application: Complete and submit your mortgage application.

- Review Offer: Examine the mortgage offer from your lender carefully.

- Finalize the Loan: Sign the mortgage agreement and complete the transaction.

Tips for a Smooth Application

- Be Thorough: Ensure all documents are complete and accurate.

- Seek Professional Advice: Consult with a mortgage broker or financial advisor for personalized guidance.

- Understand Terms: Carefully review all terms, including rate adjustment mechanisms and potential caps.

Considerations for Different Applicant Types

Different types of applicants may face specific challenges and requirements.

Self-Employed Applicants

- Income Verification: Provide comprehensive financial records, including profit and loss statements.

- Higher Risk: Be prepared for potentially higher rates or stricter terms.

Non-Swiss Residents

- Residency Status: Must provide proof of legal residency and stable income.

- Lender Requirements: Non-residents may face additional requirements or higher rates.

First-Time Home Buyers

- Down Payment: Be ready for potentially higher down payment requirements.

- Additional Documentation: Might need extra paperwork to demonstrate financial stability.

Expert Insights and Advice

Gain valuable insights from industry experts to enhance your understanding of variable rate mortgages.

Expert Opinions

- Mortgage Brokers: Recommendations for choosing the best variable rate mortgage based on current market conditions.

- Financial Advisors: Strategies for managing mortgage payments and planning for potential rate increases.

Market Trends and Predictions

- Interest Rate Trends: Analysis of current and projected interest rate trends.

- Economic Influences: How broader economic factors might impact variable interest rates.

Common Questions About Variable Rate Mortgages

Addressing frequently asked questions can help clarify common concerns.

What Happens if Interest Rates Rise?

If interest rates increase, your monthly payments will also rise, potentially impacting your budget.

Are There Caps on How Much the Rate Can Increase?

Many variable rate mortgages include caps to limit how much the interest rate can increase during each adjustment period.

Can I Convert My Variable Rate Mortgage to a Fixed Rate?

Some lenders allow conversion from a variable to a fixed rate mortgage, but terms and fees may apply. Check with your lender for specific options.

Conclusion

Variable rate mortgages offer flexibility and potential cost savings but come with risks due to interest rate fluctuations. By understanding the Swiss mortgage market, preparing the necessary documentation, and seeking expert advice, you can make an informed decision about whether a variable rate mortgage is right for you.